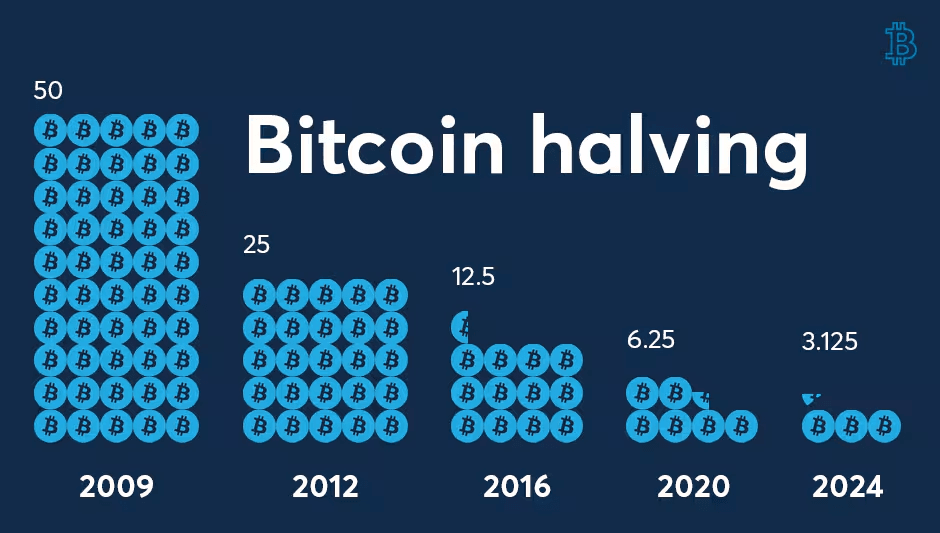

Bitcoin halving is a planned reduction in the rewards miners receive for their work in validating transactions on the Bitcoin network. The term is mentioned in Bitcoin’s code, and it occurs approximately every four years. In the Bitcoin halving, the mining reward is cut in half, which affects the supply of new bitcoins entering circulation.

Halvings are set to happen approximately every four years or every 210,000 blocks until the entire 21 million bitcoin supply is mined, expectedly by 2140. As a component of bitcoin’s deflationary strategy towards its limited supply, the forthcoming halving will decrease the bitcoin supply subsidy from 6.25 BTC per block to 3.125 BTC, thereby cultivating a stricter supply environment.

2024 bitcoin halving is expected to take place between 19th to 20th April.

Historically

Image: GME Group

Image: GME Group

Bitcoin has experienced price increases after halving events. For example, the price of Bitcoin rose from around $12 to $1,100 within a year after the first halving in November 2012.

Similarly, the price increased from $670 to nearly $20,000 within a year after the second halving in July 2016.

The third halving in May 2020 saw the price rise from around $9,500 to $69,000 within a year and a half.

What is the Impact of Halving on Bitcoin Miners?

Miners often respond to the reduced block rewards by adjusting their strategies to maintain profitability. They may invest in energy-efficient technologies, join mining pools to increase their chances of earning rewards, or prioritize transactions with higher fees to offset the decrease in block rewards.

Additionally, miners may sell more of their Bitcoin inventory to cover operational costs, which can increase the supply of Bitcoin in the market and potentially depress prices.

The recent introduction of Bitcoin ETFs has added a new dynamic to the mining landscape. These ETFs could serve as a counterbalance to the sell pressure from miners by absorbing some of the selling pressure and providing a steady demand source for Bitcoin. This could potentially reshape Bitcoin’s market structure in a positive way, benefiting the price post-halving

What is the Impact of Bitcoin spot ETFs on the Halving?

The impact of the halving on the price of Bitcoin is not guaranteed, as market conditions and investor sentiment play a significant role.

Coinbase analysts argue that the Bitcoin ETFs have changed the market dynamics, as they have established a new anchor for BTC demand. The constant demand from ETFs could be positive for Bitcoin’s price over the long-run by creating a more balanced market with less volatility from concentrated selling.

The ETFs generate between $4 billion to $5 billion in daily spot-trading volumes, which makes liquidity sufficiently large for institutions to trade without causing price crashes.

In summary, the impact of Bitcoin ETFs on the halving effect on Bitcoin’s price is not straightforward. While the ETFs have democratized access to Bitcoin and increased market liquidity, they may also weaken the halving effect on the price due to constant demand from ETFs. The actual impact on the price will depend on various factors, including market conditions and investor sentiment

What is the Impact of large liquid derivatives market on the halving**

The evolution of a large liquid derivatives market has significant implications for the Bitcoin halving. The emergence of a robust, regulated derivatives market facilitates price risks to be hedged, manages bitcoin demand risk, and provides market participants with actionable price discovery.

This development has led to several key changes:

- Hedging Price Risks: Derivatives markets enable investors to hedge their positions against price fluctuations, which can help stabilize the market and reduce the impact of sudden price movements. This is particularly important for Bitcoin, which is known for its high volatility.

- Managing Bitcoin Demand Risk: As the demand for Bitcoin increases, so does the risk of price volatility. Derivatives markets help manage this risk by providing tools for investors to take positions that balance their exposure to Bitcoin’s price movements.

- Actionable Price Discovery: Derivatives markets provide more accurate and timely price information, which can help market participants make better-informed decisions. This is crucial for understanding the impact of the halving on Bitcoin’s price.

The halving process is designed to maintain the scarcity of Bitcoin, which is a key factor in its value proposition. With the evolution of derivatives markets, miners can now hedge and lock in future bitcoin prices to cover expenses without selling their coins. This reduces the selling pressure from miners, which can potentially lead to less downward pressure on Bitcoin’s price after the halving event.

Conclusively

While past halving cycles and associated price rallies offer valuable insights, the 2024 halving introduces a unique blend of factors that could mark a new era for Bitcoin. With 28 more halving events projected over the next 112 years, the trajectory of Bitcoin adoption and network expansion demands close observation. The recent approval of spot Bitcoin ETFs in the US, less than 90 days ago, has opened up broader access to Bitcoin, adding a new dimension to its market dynamics. The convergence of institutional and retail interest with regulatory changes and macroeconomic trends underscores the need for a balanced perspective to navigate the evolving Bitcoin landscape. Understanding how Bitcoin’s scarcity interacts with market demand and how these factors evolve over time will be crucial in assessing the future growth and adoption of Bitcoin.