Cryptocurrency is rapidly becoming a mainstream investment option, and the need for safe and secure storage solutions has never been more critical. According to recent data, the total market capitalization of cryptocurrencies exceeded $1 trillion, with Bitcoin alone accounting for over 40% of the market share. As more institutions and investors enter the market, the demand for reliable storage options continues to grow. This is where custodial and non-custodial wallets come in, providing users with a safe and convenient way to store and manage their digital assets. As you read-on you will get to know the differences between these two wallets so you can in turn make better business decisions.

What is a Custodial Wallet?

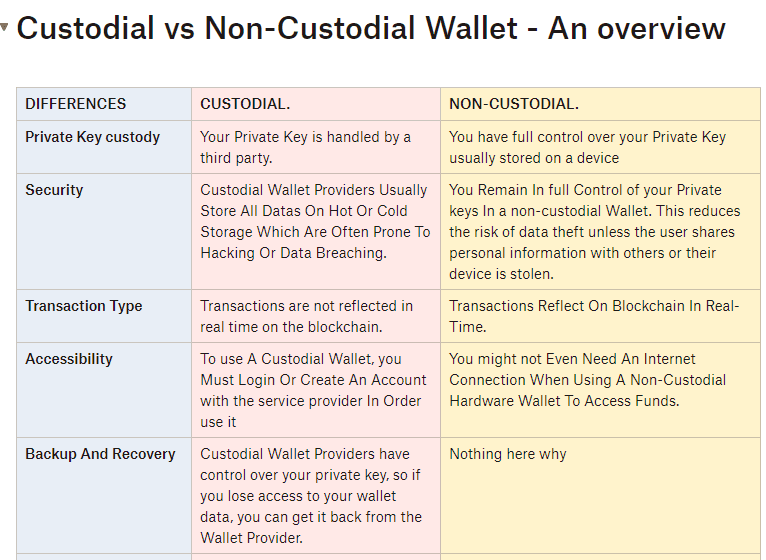

A custodial wallet is a type of wallet where a third party, such as an exchange, holds the private keys to your cryptocurrencies. Popular exchanges like Gemini, and Coinbase offer custodial wallets that make it easy for investors to transfer, store and manage their cryptocurrencies. These wallets are convenient and require less responsibility, but it’s important to note that using a custodial wallet means trusting a third party with your assets. As a result, you may not have full control over your cryptocurrencies.

Pros of Custodial Wallets.

User Friendly: Most custodial wallets have a user-friendly design. You can easily figure out a wallet’s features without any technical background.

- It is Easier to Use: Ease of use is the primary motivation for the existence of hot wallets. Tokens in custodial wallets can be used and/or traded right away.

- It is Cheaper: Custodial wallets are digital wallets offered by centralized third parties, like exchanges, which means they typically run on services and will require no gas or other costs.

- Risk of losing your private key is low: Keeping your keys safe is a major concern. With most of them, you can even get your passwords to reset or confirm your identity to regain access to your account should you lose it.

- Higher backup possibility: Another advantage of custodial wallets is that the central authority managing your wallet offers backup facilities. This makes it easier to undo any transaction or restore a previous version

Cons of Custodial Wallets.

In the same way that a bank has your money, or a casino holds your chips, a custodial wallet owes you tokens that it holds and can use for its own purposes in the meantime — such as providing liquidity for trading.

- Need for KYC: Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulation is required in many cases depending on jurisdictions and legislations applicable. You won’t be able to access your funds or any of the connected services until you can prove your identity. The requirement of identifying verification obstructs the fundamental idea of cryptocurrency, namely anonymity.

- Data Breach/Hack: Hot custodial wallets of exchanges hold a lot of tokens and Personal Private Information (PPI), which makes them prime targets for malicious actors such as hackers or other attackers.

- Internet Dependency: In order to view or transfer your tokens, you need internet access. Being cut from accessing the internet implies being cut from your capital.

What is a Non-Custodial Wallet?

It is a type of Blockchain wallet that lets you be your own bank. This implies that users have full control over their funds and their private key.

Non-custodial wallets could be browser-based, software installed on mobile devices or desktop computers, or hardware devices.

While non-custodial wallets don’t require you to trust a third party, they require you to trust yourself to keep your keys and your wallet secure. If you were to lose your wallet, destroy your wallet, or forget your password, and you haven’t taken precautions to be able to regenerate your wallet, you could lose access to your funds. However, there is a backup procedure typically, you will have generated a sequential string of 12, 18, or 24 words that are displayed upon setting up your crypto wallet.

Pros of Non-Custodial Wallet

- You Have Control Over Funds: A non-custodial wallet offers you control over wallet private keys, so you don’t have to rely on a third party to handle your cash or perform any related operations when you have control of a private key.

- Lower Risk of Data Breach/Hack: Everyone is a potential target for hackers, just like everyone is a potential target of theft. But being a single wallet with a relatively small amount of tokens compared to what an exchange would hold, reduces your risk of being targeted by attackers.

- Instant Withdrawals: Having complete control means you can move your tokens whenever you want, without any preset delay period imposed by third parties, which is a common practice with exchanges.

- Non-Internet Reliant: Local cold wallets can be accessed without any internet access, you may not be able to transact but you can at least see how many tokens you hold and that they are safe.

Cons of Non-Custodial Wallets

- No customer Service: If you make a mistake, you are stuck with the consequences. One typo can mean a loss, and there’s no way of undoing mistakes.

- Keys Lost = Money Lost: If you lose your password & seed phrase, there is no one who can help you restore your wallet or information. Be very careful !

- Higher Fees: Fees are based on ETH gas costs, which depends on the price of ETH and the congestion of the network. These fees fluctuate wildly, and get pretty high at times.

- More Responsibility: If it is your first crypto purchase, you may not be comfortable sending funds to a cold wallet, or setting one up. Although, it is not technically difficult, it can be emotionally overwhelming.

Which Wallet is better?

Custodial wallets are easier to deal with, and more convenient if you’re looking to move assets or participate in the markets. But the fear of major problems like attacks and bankruptcy should be enough to make you want a second non-custodial cold wallet to store your assets. Many people use a combination of both wallet types. It is much safer to distribute assets between multiple wallets. Bitpowr offers different wallet types to satisfy varying customer needs, including smart contract wallets, secure MPC custody, and non-custodial wallets.

If you need help with more info on wallets check out Bitpowr technologies. We provide a variety of wallet services for your businesses. We also help you build and scale your crypto business, and manage your digital assets. Sign up today for access